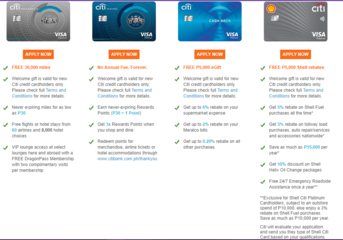

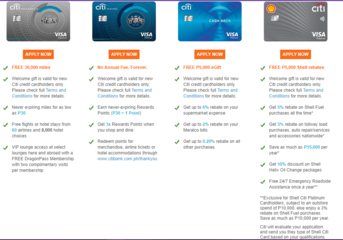

Hello! Anyone who is interested to have a credit card from Citibank? APPLY HERE

Eligibility to Apply

Required Documents to Apply for a Credit Card:

If you have another principal credit card

If you are not interested, you may read below.

Credit cards often get a bad reputation, but the truth is they can be a key financial tool if used responsibly.

Your credit card offers benefits such as:

Advantages

Convenience: You don’t have to worry about how much cash you have on hand. Just remember that you can always use a debit card instead. With a debit card you won’t be in danger of accumulating debt that will be subject to high interest charges if you don’t pay it off each month, like you would with a credit card. Remember to keep track of your checking account balance to be sure you can cover what you’re buying.

Record-keeping: A credit card provides a useful record of your spending through your monthly statement and online account, which would also be the case if you relied on a debit card for spending. Some credit cards do send year-end summaries, though, that can be a great resource when you’re doing your taxes.

Low-cost loans: You’re getting your paycheck in five days, but there’s a purchase you need to make today. You can charge your purchase now and pay off the charge after you get paid. The key here is to make sure you will be able to pay off the charge by the due date.

Cash advances: You can get money when you need it. Be aware that cash advances often have a higher interest rate, so it’s important that you have a realistic plan to pay back those advances.

Member perks: With some smart shopping, you can choose from a wide range of discounts or cash back based on your purchases.

Build a good credit history: Using a line of credit by making purchases—and paying them off on time—will help you get a good credit rating from credit rating agencies, which will make lenders more likely to lend to you and offer you a good interest rate.

Purchase protection: Your credit card may step in to help if you want to dispute a charge or return a defective product. While a debit card may offer similar protection, you will have to wait until the issue is investigated before getting your money back.

APPLY HERE

Feel free to drop your inquiries, message me if you apply and get approved thru my link.

Eligibility to Apply

- Are at least 21 years old

- Have a minimum income of:

- P180,000 per year if you have another credit card

- P250,000 per year if you have no credit card

- Have an active landline or mobile phone number

- Have a valid TIN, SSS, GSIS or UMID number

Required Documents to Apply for a Credit Card:

If you have another principal credit card

- Government-issued ID only

- Government-issued ID

- Any Proof of Income (ex. Payslip, ITR, Bank Statement of your Payroll Account showing your one-month salary, Signed Certificate of Employment and Compensation

If you are not interested, you may read below.

Why you should get a credit card

Credit cards often get a bad reputation, but the truth is they can be a key financial tool if used responsibly.

Your credit card offers benefits such as:

- Enrollment of Bills

- Security

- Travel Perks

- Rewards from Points

- Universal acceptance

Advantages

Convenience: You don’t have to worry about how much cash you have on hand. Just remember that you can always use a debit card instead. With a debit card you won’t be in danger of accumulating debt that will be subject to high interest charges if you don’t pay it off each month, like you would with a credit card. Remember to keep track of your checking account balance to be sure you can cover what you’re buying.

Record-keeping: A credit card provides a useful record of your spending through your monthly statement and online account, which would also be the case if you relied on a debit card for spending. Some credit cards do send year-end summaries, though, that can be a great resource when you’re doing your taxes.

Low-cost loans: You’re getting your paycheck in five days, but there’s a purchase you need to make today. You can charge your purchase now and pay off the charge after you get paid. The key here is to make sure you will be able to pay off the charge by the due date.

Cash advances: You can get money when you need it. Be aware that cash advances often have a higher interest rate, so it’s important that you have a realistic plan to pay back those advances.

Member perks: With some smart shopping, you can choose from a wide range of discounts or cash back based on your purchases.

Build a good credit history: Using a line of credit by making purchases—and paying them off on time—will help you get a good credit rating from credit rating agencies, which will make lenders more likely to lend to you and offer you a good interest rate.

Purchase protection: Your credit card may step in to help if you want to dispute a charge or return a defective product. While a debit card may offer similar protection, you will have to wait until the issue is investigated before getting your money back.

APPLY HERE

Feel free to drop your inquiries, message me if you apply and get approved thru my link.

Last edited: