Thank you for sharing yung

Viber ng BPI, those numbers work and able to speak with them kanina lang about waiving of annual fee.

I actually never bothered waiving AF for 4 years that I've owned their Blue Mastercard, simply because I didn't know. I can't recall kung na-explain sakin nung nag-open ako cc or hindi ko naintindihan o hindi nakikinig

kanina lang talaga nung nagbabasa ako dito then researched further about it at 'yun nga may waive waive palang eme. Unfortunately, nitong year lang ako gumagastos since I set aside agad mga salaries ko sa Passbook, kaya onti lang din binigay options sakin for waiving AF.

- Convert to 12 Months Payment 0% Interest

- Get a Supplementary Card

- Apply for Loan

#2 and #3 aren't an option for me. Don't need those at the moment.

Yung #1 is napag isip-isip ko ay it's really not WAIVE but pinaliit lang yung AF mo in a form of monthly payment instead of isang bagsakan na bayad for the whole year. I politely asked more sa kausap ko kanina but she got no answer for me about #1, 'di nalang ako nangulit.

Another lesson,

try and try with your bank na ma waive AF.

BPI is my only bank (Checkbook, Passbook, Regular Savings, Payroll and Credit Card (+BPI eCredit Card)). Tama ka po dun sa cc nila, hindi ko ramdam perks at yung rate ng Real Thrill Rewards nila parang hindi makatarungan; or baka hindi pa ako ganun ka knowledgeable sa rates ng mga bank rewards.

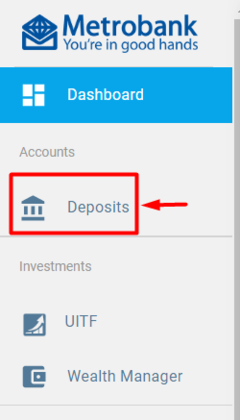

But since I only have experience with BPI since nung Student Blue Card pa nila (Maya Savings?) kaya lahat na ng Savings and Checking accounts ko sa BPI ko narin pinagawa, but now I think I should explore other banks, find banks that have better perks like PNB-PAL Mabuhay Miles World Mastercard (na I heard mas madali Peso Spend = Mile Points nila) or yung promo ng Metrobank na Trip-for-3 sa Japan etc. I'm a frequent traveler so I want to find the best card for travelling. Right now still researching, researching and researching...

Yes po, okay naman. I linked my Blue Mastercard Credit Card duon sa PayPal before, then when BPI offered me the eCredit Card, inunlink ko na yung cc ko sa PayPal since I prefer to use the eCredit Card for online purchases. If you have BPI cc and often do online purchases, then goods yung eCredit Card (but it has limits since sa mismong Credit Card mo rin siya mababawas).

Lot of sites, games and platform where PayPal is one of payment option kaya goods rin to have PayPal. I still have mine but GCash Mastercard and GCash American Express naka-link.

Another thing that I've heard is — madali daw makakuha ng higher or premium cards if marami kang credit/debit cards; aside form getting good credit score or unless you have lot of funds for higher cards. Not sure about this so...

Sub po ako on this thread at baka makapulot pa ako ng kaalaman with Credit Cards.