- Messages

- 2,145

- Reaction score

- 5

- Points

- 28

USAPANG UTANG: ALAMIN MUNA ANG MAHALAGANG INFO

Tandaan:

An informed citizen is the best asset of a country. It is best to discuss an issue with solid information rather than fleeting passions and emotions.

SHORT HISTORY OF PHILIPPINE NATIONAL DEBT

- In 1961, Diosdado Macapagal departed from the nationalist policies of predecessor Carlos Garcia and he embraced free enterprise and opened doors to free investment.

- In return, the United States, the International Monetary Fund, and the World Bank offered the government huge loans. It was thought that the foreign capital could be a catalyst for development. This was however our entry into the debt trap.

- When Ferdinand Marcos became president in 1965, he continued Macapagal's economic liberalization policies. The immediate result was that the debt rose from 277.7 million dollars to 840.2 million by the end of his term. When Marcos imposed martial law, the trend toward economic liberalization accelerated. And he borrowed from outside to finance deficit and nationalists like Tañada, Recto, Garcia, and Diokno did not even oppose this decision.

- Almost 35 years after Marcos' regime, his successors were still not able to rescue the country from debts and rather only increased it.

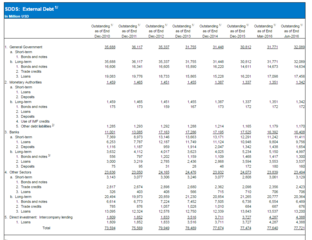

External Debt -The portion of a country's debt that was borrowed from foreign lenders including commercial banks, governments or international financial institutions. These loans, including interest, must usually be paid in the currency in which the loan was made.

Internal debt - The part of the total debt in a country that is owed to lenders within the country. A country occasionally needs to borrow from institutional and individual investors for budgetary purposes.

National Debt - Total outstanding borrowings of a central government comprising of internal (owing to national creditors) and external (owing to foreign creditors) debt incurred in financing its expenditure.

A debt crisis ensues when a national government cannot pay the debt it owes and seeks, as a result, some form of assistance. It deals with national economies, international loans and national budgeting. The definitions of "debt crisis" have varied over time, with major institutions such as Standard and Poor's or the International Monetary Fund (IMF) offering their own views on the matter.

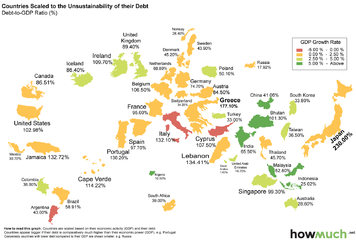

Debt-to-GDP ratio

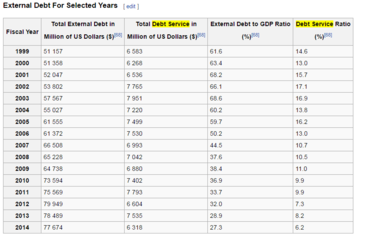

The Debt-to-GDP ratio is the proportion of a country’s Federal debt in relation to its total output or GDP. According to the Bangko Sentral ng Pilipinas (BSP), the ratio of what the Philippines owes from foreign creditors (external debt) to what it has been producing (GDP) has gone through a significant growth from 61.6% in 1999 to 68.2% in 2001. The ratio fluctuates until 2004 where it started a steady decline up to 2008. It rose again to 38.4% in 2009, but eventually fell down to 36.9% in 2010. Up until last year, the trend is declining, with a 27.3% ratio at the end of 2014. Figures have generally been fluctuating (in terms of public and private external debt). Governments basically aim for low debt-to-GDP ratios because such is an indicator that the economy is producing high enough output to pay off its borrowings.

Debt-to-Revenue Ratio

The debt-to-revenue, according to the NTRC, is an important calculation in evaluating the government’s ability to manage its debt. It measures the percentage of total revenue that is allocated to debt principal and interest payments. With the constant increase in the debt to revenue ratio, it becomes more difficult for the government to handle its national debt.

From almost a steady ratio of 420% in 2000-2001, the country’s debt-to-revenue ratio went down to 364% and 354% in 2011 and 2012, respectively. However, ratio started to soar as high as 539% in 2004. Between 2005-2007, the ratio slipped to as low as 327% then rose again to 391% in 2010.

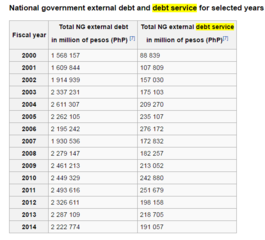

Debt service ratio

Republic Act 6142 of 1970 defined the debt-service ratio as the proportion of the Philippines’ principal and interest payments on medium- and long-term debt to total external receipts or export earnings.For the past 15 years, the Philippines’ debt service burden (DSB) to exports on goods and receipts from services and income noticeably fell over half from 14.6% in 1999 to 6.2% in 2014. From 2001 to 2009, the figures have been fluctuating. However, the ratios for 2009 until 2014 maintained a trend of decline. This is preferred since low debt service ratio characterize better international finances.

Major Risks of Debt Crisis

- High external debts are believed to have harmful effects to the economy.

- The reputation of a country is also at stake when external debt is looked at and may discourage investments to enter into the country.

- The present foreign investors in the country would be expected to pull capital out of the country.

- It would lead to a decline in the Peso, making the debt burden (which is largely denominated in dollars) more onerous.

The Gross Domestic Product (GDP) of Philippines was worth 272.02 billion US dollars in 2013. The GDP value of Philippines represents 0.44 percent of the world economy. GDP of the Philippines averaged 60.12 USD Billion from 1960 until 2013, reaching an all-time high of 272.02 USD Billion in 2013 and a record low of 4.40 USD Billion in 1962.

The Gross Domestic Product (GDP) of the Philippines expanded 5.30 percent in the third quarter of 2014 over the same quarter of the previous year. GDP Annual Growth Rate averaged 5.02 Percent from 2001 until 2014, reaching an all-time high of 8.90 Percent in the second quarter of 2010 and a record low of 0.50 Percent in the third quarter of 2009. GDP Annual Growth Rate of Philippines is reported by the Philippine National Statistical Coordination Board.

Generally, Government debt as a percent of GDP is used by investors to measure a country's ability to make future payments on its debt, thus affecting the country's borrowing costs and government bond yields.

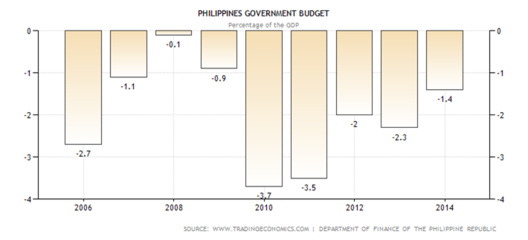

The Philippines recorded a Government Budget deficit equal to 1.40 percent of the country's Gross Domestic Product in 2013. Government Budget in Philippines averaged -2.17 Percent of GDP from 1988 until 2013, reaching an all time high of 1 Percent of GDP in 1994 and a record low of -5.30 Percent of GDP in 2002. Government Budget in Philippines is reported by the Department of Finance of the Philippine Republic.

Government Budget is an itemized accounting of the payments received by government (taxes and other fees) and the payments made by government (purchases and transfer payments). A budget deficit occurs when an government spends more money than it takes in. The opposite of a budget deficit is a budget surplus.

HOW DOES THE PHILIPPINE GOVERNMENT PAY ITS EXTERNAL DEBT?

Debt Service - The cash that is required for a particular time period to cover the repayment of interest and principal on a debt. Debt service is often calculated on a yearly basis.

Debt burden is the cost of servicing the public debt. Most of this debt burden is a really transfer from one generation to another.

The previous administration viewed that maintaining a budget deficit at 2% of GDP, equivalent to P283.7 billion, would allow the administration to continue pursuing reforms to increase revenue collections without burdening the people with additional debt.

Borrowings

The projected deficit for 2015 is P283.7 billion. To cover this gap between disbursements and revenues, the administration will borrow P700.8 billion, reducing the country’s debt stock while also helping develop domestic capital markets.

The goal is to raise 86.3% of the borrowing program (P605.1 billion) through the issuance of treasury bills and bonds to local investors. The remaining 13.7% (P95.7 billion) will be sourced externally through concessional loans from development partners and the issuance of dollar bonds in global capital markets.

Good News!

The Philippines continues to pare down its foreign debt servicing to $1.538 billion as of this year or 37.32 percent less than the $2.454 billion in the same period last year, the Bangko Sentral ng Pilipinas (BSP) reported.

Estimated Calculation for Debt Burden for both foreign and domestic debts of the Philippines:

Based on the 2015 Annual Budget

Debt Burden - P399.4 billion

Domestic Debt Increase per annum resulting from budget deficit- P700.8 billion (That if the government can stabilize the budget deficit of 2% out of the total GDP.

Foreign Debt Service- $3.09 Billion ( P137.63 Billion)

Philippine Debt Sustainability

Debt sustainability is a major issue, particularly for countries facing higher public debts, such as what most advanced economies are currently experiencing. These countries are vulnerable to rollover risks as maturing debt obligations could become more expensive to refinance considering that investors will demand significant premium to compensate for the greater risks that they will be assuming. The punitive action of the market through higher borrowing costs will make it more difficult for these countries to service their obligations, creating a vicious cycle of debt trap. This could be aggravated when governments planning to undertake unpopular measures that will increase revenues and/or reduce public expenditures face political backlash that render them not politically feasible.

According to NTRC, the country’s debt sustainability assessment for 2012-2017 shows that investors have a positive outlook on the country’s economy.

It is said that a high debt level could be perceived as sustainable by investors if it is decreasing. The country’s projected debt sustainability from 2012 to 2017 depicts downward trends in debt-to-GDP and debt-to-revenue that lead to further improvement in market perceptions. The ratio indicates that for every PhP100 worth of goods and services the country produces in the economy between the years 2012-2017, the country must use around PhP42 to PhP55 for debt repayment.

However, it is still fundamental for the government to practice proper debt management to avoid payment defaults and/or debt service eating up much of the revenues of the government (debt overhang).

Essential Debt Indicators (to follow, no more room for attachment)

Attachments

-

figure 01.png53.8 KB · Views: 1

figure 01.png53.8 KB · Views: 1 -

figure 01.png20.7 KB · Views: 308

figure 01.png20.7 KB · Views: 308 -

figure 02 GDP.png35.8 KB · Views: 305

figure 02 GDP.png35.8 KB · Views: 305 -

figure03 GDP annual growth rate.png33.5 KB · Views: 306

figure03 GDP annual growth rate.png33.5 KB · Views: 306 -

figure04 debt to gdp ratio.png35.9 KB · Views: 306

figure04 debt to gdp ratio.png35.9 KB · Views: 306 -

figure05 govt budget percentage of GDP.png32 KB · Views: 302

figure05 govt budget percentage of GDP.png32 KB · Views: 302 -

additional01.PNG41 KB · Views: 302

additional01.PNG41 KB · Views: 302 -

additional02.PNG34.1 KB · Views: 301

additional02.PNG34.1 KB · Views: 301 -

additional03.PNG32.7 KB · Views: 303

additional03.PNG32.7 KB · Views: 303 -

Long-Term and Short-Term Debts.PNG59.7 KB · Views: 2

Long-Term and Short-Term Debts.PNG59.7 KB · Views: 2

Last edited: