Symbianize Forum

Most of our features and services are available only to members, so we encourage you to login or register a new account. Registration is free, fast and simple. You only need to provide a valid email. Being a member you'll gain access to all member forums and features, post a message to ask question or provide answer, and share or find resources related to mobile phones, tablets, computers, game consoles, and multimedia.

All that and more, so what are you waiting for, click the register button and join us now! Ito ang website na ginawa ng pinoy para sa pinoy!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Philippine Stock Market Tutorials! Dito PINAKAMAGANDA MAG-INVEST NG PERA!!!

- Thread starter albert_m_francisco

- Start date

- Replies 341

- Views 48,477

More options

Who Replied?- Messages

- 1,166

- Reaction score

- 0

- Points

- 26

pde malaman paoano ung technik nu sa MA po ano pong MA# gamit nu?cross over po ba?fib n rsi kunti lang alam ko per ung ichimoku pag aaralan plang po.hehehe

Gumagamit ako ng 2 short term MAs(MA9, MA20), 1 medium term MA(MA50), 2 long term MAs(MA100, MA200). Di ko ma-explain dito paano gamitin yan kasi bawat isa sa kanila napakaraming gamit, kulang pa isang araw ko para mag explain haha

. Pwede kasi maging lagging at leading indicator ang MA, ito ang pnakapaborito kong indicator sa lahat.

. Pwede kasi maging lagging at leading indicator ang MA, ito ang pnakapaborito kong indicator sa lahat.Fibo naman para sa support/resistance, retracements

RSI para sa support/resistance, divergences, strength ng stock

Itchy pang dagdag ng conviction ko

- Messages

- 127

- Reaction score

- 0

- Points

- 26

Gumagamit ako ng 2 short term MAs(MA9, MA20), 1 medium term MA(MA50), 2 long term MAs(MA100, MA200). Di ko ma-explain dito paano gamitin yan kasi bawat isa sa kanila napakaraming gamit, kulang pa isang araw ko para mag explain haha. Pwede kasi maging lagging at leading indicator ang MA, ito ang pnakapaborito kong indicator sa lahat.

Fibo naman para sa support/resistance, retracements

RSI para sa support/resistance, divergences, strength ng stock

Itchy pang dagdag ng conviction ko

unahin natin short term sir.. MA9ma20 handa ako matuto at ma i backtest sir gaya ng isa din nkausap ko sabi sakin ung ema5&ma20 xover nila for entry with rsi stochastic po ...bina backtest ko sa po cia at pinag aaralan.. sa Ma9 &ma20 sir ano po gamit nya x over din po ba?for entry?

- Messages

- 17

- Reaction score

- 0

- Points

- 16

Hi guys! Question for those who are investing in stocks esp for long term basis. What effective strategy can you recommend? PCA? SAM? Or is it more prfitable being a day trader? What are your takes on these? Thanks for your feedback!

- Messages

- 132

- Reaction score

- 2

- Points

- 28

Hi guys! Question for those who are investing in stocks esp for long term basis. What effective strategy can you recommend? PCA? SAM? Or is it more prfitable being a day trader? What are your takes on these? Thanks for your feedback!

Depende po sa oras at priorities mo. Kung nagfofocus ka sa work/business mo and gusto mo lang gawin na parang alkansya ang Stock Market, I suggest doing PCA or SAM (SAM kung may budget ka pang join sa TRC). Pero kung gusto mo ito gawing career and you are willing to spend time studying and watching the market, then you can be a day trader. Both strategies naman (active or passive investing) can be profitable as long as napagaralan mo.

Personally, my work ako now and online business sa side, so wala ako masyado time sa stocks. Therefore, I'm using SAM.

- Messages

- 17

- Reaction score

- 0

- Points

- 16

Depende po sa oras at priorities mo. Kung nagfofocus ka sa work/business mo and gusto mo lang gawin na parang alkansya ang Stock Market, I suggest doing PCA or SAM (SAM kung may budget ka pang join sa TRC). Pero kung gusto mo ito gawing career and you are willing to spend time studying and watching the market, then you can be a day trader. Both strategies naman (active or passive investing) can be profitable as long as napagaralan mo.

Personally, my work ako now and online business sa side, so wala ako masyado time sa stocks. Therefore, I'm using SAM.

Thanks po sa pag reply. May work din po ako sa ngaun at hindi ko rin kakayanin ang active trading. Gaano katagal na po kayo naiinvest sa stocks? At monthly din po ba ang pagbili nyo? Sa diversification, may mutual funds din po ba kayo or mainly stocks?

- Messages

- 1,166

- Reaction score

- 0

- Points

- 26

unahin natin short term sir.. MA9ma20 handa ako matuto at ma i backtest sir gaya ng isa din nkausap ko sabi sakin ung ema5&ma20 xover nila for entry with rsi stochastic po ...bina backtest ko sa po cia at pinag aaralan.. sa Ma9 &ma20 sir ano po gamit nya x over din po ba?for entry?

balikan kita pag may time or sa weekend kasi mejo busy pa.. di rin ako maka tutor sa fb kasi may day job ako, busy din ako sa gabi

Hi guys! Question for those who are investing in stocks esp for long term basis. What effective strategy can you recommend? PCA? SAM? Or is it more prfitable being a day trader? What are your takes on these? Thanks for your feedback!

No offense to TRC members, but for me I don't really recommend anyone to join groups like TRC.

To be honest naging member ako ng TRC for 6 months (nag-try ako semi-annual account) at may gains naman kahit nasa 4-5months palang ako. Monthly ako bumibili using peso cost averaging with his SAM table. Pero kahit ok naman yung nangyari sa account ko, I feel so blind... following a table of stocks na di mo alam pano nila ginawa or pinili. Sa stock market kasi, pera mo.. obligasyon mo. Dahil dun nag invest ako sa books at youtube vids para matuto. Hindi porket recommended nila ay bibilhin mo na... delikado yun sa market.

I suggest you invest on books, stock market books.. search mo sa google lalo na yung kay O'Neil (How to Make Money in Stocks) tsaka yung kay Jason Cam (Trading Code) for basic charting. Pwede ka naman mag long term basta alam mo kung ano ang dapat bilhin at kelan ka bibili. Hindi rin rason na wala kang time kng balak mo talagang pumasok sa market. Professional din po ako and I work more than 12 hrs a day, pero nagbibgay talaga ako ng time para matuto.

Pero nasa iyo parin ang desisyon..

Lamang ang may alam.

Happy investing

- Messages

- 132

- Reaction score

- 2

- Points

- 28

Thanks po sa pag reply. May work din po ako sa ngaun at hindi ko rin kakayanin ang active trading. Gaano katagal na po kayo naiinvest sa stocks? At monthly din po ba ang pagbili nyo? Sa diversification, may mutual funds din po ba kayo or mainly stocks?

More than 1 year palang po ako nagiinvest sa stocks. Monthly po ako nagdedeposit sa broker ko (COL), pero bumibili ako ng stocks kapag may magandang buy signal lang. Hindi po kasi pure SAM ang strategy ko. Bumibili lang ako ng SAM stocks pero hinahaluan ko ng konting trading strategies like price action and BSSR (buy near support-sell near resistance).

So far, I diversify only in two asset classes: stocks (wala po akong mutual funds) and my business.

- Messages

- 17

- Reaction score

- 0

- Points

- 16

No offense to TRC members, but for me I don't really recommend anyone to join groups like TRC.

To be honest naging member ako ng TRC for 6 months (nag-try ako semi-annual account) at may gains naman kahit nasa 4-5months palang ako. Monthly ako bumibili using peso cost averaging with his SAM table. Pero kahit ok naman yung nangyari sa account ko, I feel so blind... following a table of stocks na di mo alam pano nila ginawa or pinili. Sa stock market kasi, pera mo.. obligasyon mo. Dahil dun nag invest ako sa books at youtube vids para matuto. Hindi porket recommended nila ay bibilhin mo na... delikado yun sa market.

I suggest you invest on books, stock market books.. search mo sa google lalo na yung kay O'Neil (How to Make Money in Stocks) tsaka yung kay Jason Cam (Trading Code) for basic charting. Pwede ka naman mag long term basta alam mo kung ano ang dapat bilhin at kelan ka bibili. Hindi rin rason na wala kang time kng balak mo talagang pumasok sa market. Professional din po ako and I work more than 12 hrs a day, pero nagbibgay talaga ako ng time para matuto.

Pero nasa iyo parin ang desisyon..

Lamang ang may alam.

Happy investing

Thanks po for your insights, I really find it useful and will look into those resources. As I can't agree more, we really have to learn how the system works. We cant just solely be dependent on what they're feeding us.

God bless po

- Messages

- 17

- Reaction score

- 0

- Points

- 16

I'm planning to invest in mutual funds as well, what is the difference b/n Philequity Fund vs Philequity Index Fund? What would be the better option and why?

balikan kita pag may time or sa weekend kasi mejo busy pa.. di rin ako maka tutor sa fb kasi may day job ako, busy din ako sa gabi

No offense to TRC members, but for me I don't really recommend anyone to join groups like TRC.

To be honest naging member ako ng TRC for 6 months (nag-try ako semi-annual account) at may gains naman kahit nasa 4-5months palang ako. Monthly ako bumibili using peso cost averaging with his SAM table. Pero kahit ok naman yung nangyari sa account ko, I feel so blind... following a table of stocks na di mo alam pano nila ginawa or pinili. Sa stock market kasi, pera mo.. obligasyon mo. Dahil dun nag invest ako sa books at youtube vids para matuto. Hindi porket recommended nila ay bibilhin mo na... delikado yun sa market.

I suggest you invest on books, stock market books.. search mo sa google lalo na yung kay O'Neil (How to Make Money in Stocks) tsaka yung kay Jason Cam (Trading Code) for basic charting. Pwede ka naman mag long term basta alam mo kung ano ang dapat bilhin at kelan ka bibili. Hindi rin rason na wala kang time kng balak mo talagang pumasok sa market. Professional din po ako and I work more than 12 hrs a day, pero nagbibgay talaga ako ng time para matuto.

Pero nasa iyo parin ang desisyon..

Lamang ang may alam.

Happy investing

Boss ano po fb account mo, baka pwede naman akp masingit sa fb tutorials mo, sa ngayon kasi yung virtual money ni investigram ang gamit ko para matuto kay stock market. Wala pa akong real account sa ngayon. Kaya nung una nanghula muna ako ng bibilhin na stock, kasi walang recomended si investigran kung anong bibilhin, nunh nakabili na ako, saka ko lng ginamitsn ng ma 20 and ma 50, so far wala pa akong na-buy and na-sell gamit yung method na to kasi wala pang nag crossover since 1nonth palang ako and long term ang ginagamit kong method. Di pa rin ako sure sa method ko. Hahaha

Last edited by a moderator:

- Messages

- 1,166

- Reaction score

- 0

- Points

- 26

I'm planning to invest in mutual funds as well, what is the difference b/n Philequity Fund vs Philequity Index Fund? What would be the better option and why?

Sorry po, I'm not the mutual fund kind of investor.. pero up natin yan.

BOSS ANO PO FB ACCOUNT MO, BAKA PWEDE NAMAN AKP MASINGIT SA FB TUTORIALS MO, SA NGAYON KASI YUNG VIRTUAL MONEY NI INVESTIGRAM ANG GAMIT KO PARA MATUTO KAY STOCK MARKET. WALA PA AKONG REAL ACCOUNT SA NGAYON. KAYA NUNG UNA NANGHULA MUNA AKO NG BIBILHIN NA STOCK, KASI WALANG RECOMENDED SI INVESTIGRAN KUNG ANONG BIBILHIN, NUNH NAKABILI NA AKO, SAKA KO LNG GINAMITSN NG MA 20 and MA 50, SO FAR WALA PA AKONG NA-BUY AND NA-SELL GAMIT YUNG METHOD NA TO KASI WALA PANG NAG CROSSOVER SINCE 1NONTH PALANG AKO AND LONG TERM ANG GINAGAMIT KONG METHOD. DI PA RIN AKO SURE SA METHOD KO. HAHAHA

Sorry bro, gustuhin ko man mag-turo, busy talga ako sa day job ko. Invest ka sa books like Trading Code marami kang matutuhan sa book na yun for basic charting, How to Make Money in Stocks by O'Neil for TA and FA analysis, tpos marami pa jan. Nagbabasa ako ng mga books kapag may free time..

Maganda din yung virtual trading, pero iba talaga sa actual zone ka na. Mas clingy ka kasi kapag nakabili ka na tpos lalaruin na yan yung emotions mo.

Happy investing

- Messages

- 17

- Reaction score

- 0

- Points

- 16

I'm planning to invest in mutual funds as well, what is the difference b/n Philequity Fund vs Philequity Index Fund? What would be the better option and why? Thanks po sa makakasagot

- Messages

- 132

- Reaction score

- 2

- Points

- 28

I'm planning to invest in mutual funds as well, what is the difference b/n Philequity Fund vs Philequity Index Fund? What would be the better option and why? Thanks po sa makakasagot

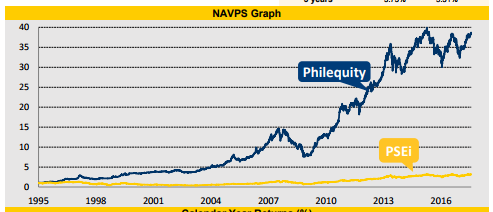

Philequity Fund is an actively managed fund that prides itself by constantly beating the PSEi index. Meron itong 1.5% annual management fee.

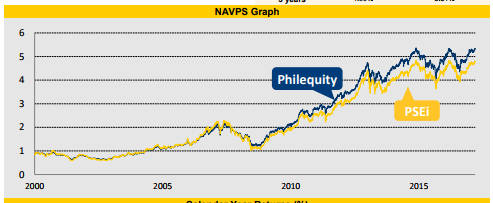

Philequity Index Fund, on the other hand, is a fund that tracks the PSEi, meaning kung ano yung galaw ng PSEi halos ganun din ang Philequity Index Fund. Since it just tracks the index, mas mababa ang annual management fee nito at 1%.

Here's a graph on how Philequity fund compares to the PSEi:

View attachment 323657

Here's how Philequity Index fund compares to the PSEi:

View attachment 323658

Hope this helps.

Attachments

- Messages

- 1,166

- Reaction score

- 0

- Points

- 26

My Top 6 Stocks for the Week

RWM

CAT

ORE

PCOR

PLC

CEI

TAYOR..

RWM

CAT

ORE

PCOR

PLC

CEI

TAYOR..

- Messages

- 127

- Reaction score

- 0

- Points

- 26

My Top 6 Stocks for the Week

RWM

CAT

ORE

PCOR

PLC

CEI

TAYOR..

idol bka pede malaman ung mga kinonsider nu kung bkit nakasama sa watchlist nu mga yan? Like "AOTS" ba? tnx

Last edited:

- Messages

- 38

- Reaction score

- 0

- Points

- 26

Maraming salamat sa Help! sir malaking tulong to! Gbu

- Messages

- 1,166

- Reaction score

- 0

- Points

- 26

My Top 6 Stocks for the Week

RWM

CAT

ORE

PCOR

PLC

CEI

TAYOR..

Nasa base-building pa halos lahat.. so Ore lng nalaglag.

Balak ko gumawa ng tutorial thread next time.. kapag di na busy

- Messages

- 1,166

- Reaction score

- 0

- Points

- 26

Sana may ebook na sa mga local author about stock investing.

CLICK ME FOR FREE TRADING BOOKS

Support local authors and their books.

Yung bayad mo sa book barya lang yan sa future earnings at sa matututuhan mo.

Tandaan mo, lugi ang walang alam sa stock market, baka yung loss mo pwede ibili ng isang buong library

Similar threads

- Replies

- 0

- Views

- 149

- Replies

- 49

- Views

- 826