- Messages

- 1,430

- Reaction score

- 0

- Points

- 26

guys baka pwede paki explain sakin yung concept ng cashflows. penge na rin ng example kung pwede. hehe.

For me: cash flow is the in and out of cash on that particular period..The cash balance should be equal on balance sheet's cash account....

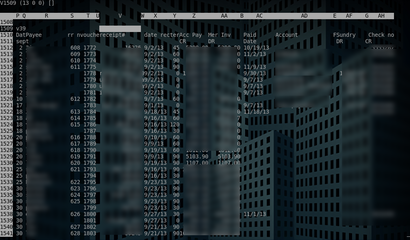

Sample::

Cash flow from ----

for sept.....

sales---------------------------100000

purchases -----60000

rental ------------10000

etc......

Net cash provided by ------- 30000

cash bal at the beg.----------10000

cash balance at the end----40000

Last edited: