Stock Alert: Don’t Sell!

“Ang Magpanic… Talo!”

As I write this essay, today’s stock market index went down again by almost 6%.

We started this year with the stock market index at around 7800; Today, we’re now at 5450; We’ve gone down by 30% so far.

And we expect MORE volatility.

I know you know this already, because I keep preaching this to you, but sometimes, when fear takes over, we get emotionally rattled, forgetting what we know.

So no matter how much panic you feel, I’m here to remind you again: Don’t Sell.

“Ang magpanic, talo!”

Why?

Chisel this on rock: THIS TOO WILL PASS.

Put it in your phone screensaver: THIS TOO WILL PASS.

Write it on your mirror: THIS TOO WILL PASS.

Tattoo it in your arm: THIS TOO WILL PASS

This market will recover.

All the red you’re seeing in your portfolio is TEMPORARY.

We don’t know when it will bounce back.

That’s the magic question.

A few months from now? A year from now?

We don’t know, and it’s NOT very important.

If you’re a long-term investor that intends to invest for the next 20 years, YOU’RE DOING GREAT. One day, 10 to 20 years from now, you’ll look back at your stocks and discover that all this bruhahaha and frenzy was just be a TINY BLIP in your journey towards your millions.

Keep Buying Regularly—But No Panic Buying

And as usual, keep buying every month.

Our stocks have never been this cheap.

BUT NO PANIC BUYING TOO.

When you’re awed by how cheap the stocks are now, you’ll be tempted to dump all your cash into the stock market. Don’t do that. Why? Because we don’t know how low the stocks will go. It might go down even lower. So having cash is good.

So just do your regular buying every month—20% of your income.

If you have a lot of cash on your hands, divide by 10 tranches—and put into the market for the next 10 months.

In Summary: No Panic Selling, No Panic Buying.

Stock Alert:

As Long As You Don’t Sell,

You’re Okay!

Today, the stock market reopened after the government suspended trading for two days. And what a crazy opening it was!

This was by far the scariest day ever since the pandemic began. Because our biggest companies in the Philippines—BDO, AC, ALI, even JFC--dove down by as much as 20% in one day.

And this is striking fear among many investors.

No wonder people are asking me:

“Bo, can my stocks go down to zero?” (Answer: “No! They’re giants!”)

“Should I sell now before it disappears?” (Answer: “Never Sell!”)

“Is this the end of the world for our economy?” (Answer: “This crisis is temporary! We will recover.”)

Let me tell you the first time I experienced an economic crisis of this magnitude…

My War Story Of 2008

Whatever is happening now has happened before.

In 2007, I entered the stock market. (Before that, I was investing in mutual funds.) For the first time, I met my mentor Edward Lee over lunch, and he opened up the world of the stock market. He promised to teach me. And I was so excited. So I started buying my first few stocks and was so happy seeing it go up little by little.

Guess what happened in 2008, just a few months after I came in?

BOOOOOOOOM. A global financial crisis exploded, triggered by the subprime fiasco. (Uber-Simplistic Summary: Many people in the US were borrowing heavily to buy 2, or 3, or 4, or 5 houses, believing they can sell them at a higher price and depended on rental income to pay their monthly amortization. This was ticking time bomb waiting to explode, but the biggest Banks “covered” up the impending explosion through very sophisticated bonds and other shenanigans, spreading the risk to other banks, even outside the US. “Trusted” rating agencies were in cahoots with this cover-up.)

Result? All the stock market of the world took a nose-dive.

So imagine me, a newbie.

When I entered the market in 2007, the Philippine Stock Market Index (PSEi) was at 3900. By 2008, it crash landed to 1400.

My stocks lost an average of 60%+

My heart sank. Imagine if I had a million in the market. That meant “on paper”, I lost P600,000. Help!

In my panic, I called Edward Lee.

And he said, “Don’t worry, Bo. I’ve seen this many times before. You’re okay. Never sell. This will bounce. And if you have a little money set aside every month, just keep buying…”

True enough, one year later, by the end of 2009, index was up at 3000.

By the end of 2010, it was at 4200—even higher than where it started (3900) before the crash.

I learned my first lesson.

Since then, I smile when there’s a crisis.

At my introductory seminar, How To Make Millions In The Stock Market, I always give the 4 most basic Rules of Investing, and Rule #2 is “Invest Even When There’s A Crisis”.

I’ve been able to multiply my money with this simple strategy.

And you can too.

Where Are We Now?

Today, the Index is at 4600. (It even went down to 4000 at the opening, but inched up.)

At the start of 2020, it was at 7800. (Last 2018, it went to a high of 9000!)

That means our stocks has already fallen by around 40% from 7800 and 48% from 9000.

We don’t know how much lower this will go.

But if you’re not going to sell anyway, your money not affected by this.

It just seems like it, because you see it in your portfolio. But that’s just “on paper”.

So see the 40% to 48% as a discount when you buy the stocks this month.

Once again, I repeat my instructions: No Panic Buying in the Stock Market. Just your regular monthly investments please. Why? You don’t know if the market will go lower.

So just keep buying your small amounts every month.

You’re okay.

The bounce is coming.

Be patient.

Be calm.

And keep investing.

May your dreams come true,

Bo Sanchez

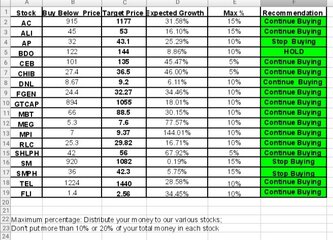

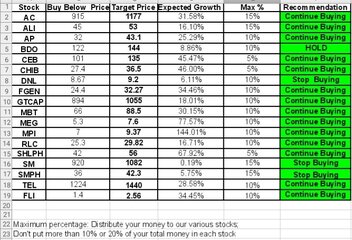

Enjoy your shopping! Wala pa po stock update. Laters!

Enjoy your shopping! Wala pa po stock update. Laters!

. This month pa lang ako nag start maginvest via COL Financial and I'm on my way to understand stocks better. Kaya pala suggest ni Bro. Bo na if my Portfolio is below 50,000, better buy Philequity Indux Fund dahil mahirap din pala ibudget pag bibili ka pa sa stocks ng other companies since my inaaalala ka pang "Board Lot". Lalo na for newbies gaya ko medyo nahihirapan pa

. This month pa lang ako nag start maginvest via COL Financial and I'm on my way to understand stocks better. Kaya pala suggest ni Bro. Bo na if my Portfolio is below 50,000, better buy Philequity Indux Fund dahil mahirap din pala ibudget pag bibili ka pa sa stocks ng other companies since my inaaalala ka pang "Board Lot". Lalo na for newbies gaya ko medyo nahihirapan pa

but anyway, ano po ibig sabihin nyo dun sa hold? di nyo po muna dadagdagan?

but anyway, ano po ibig sabihin nyo dun sa hold? di nyo po muna dadagdagan?